So, forex trading is all about buying and selling different countries’ currencies. You’re trying to make money by guessing whether one currency will go up or down compared to another.

Think of it like this: you might bet that the Euro will be worth more compared to the US dollar in the future. If you are right, you make a profit. If you are wrong, you could lose money.

What makes forex kind of a big deal? Well, it’s the biggest market out there! Money is changing hands all the time, all over the globe. It pretty much never stops. You can trade almost any time of day or night, five days a week. It is only closed on the weekends.

Because so much money is constantly flowing in and out of the forex market, it means it’s very easy to buy and sell currencies quickly. Also, because it goes on all the time, you can use a bunch of ways to trade, whether you want to make quick trades or stick with something for a while.

Now, if you are thinking about how to do forex trading in India, it would be best if you kept a few things in mind.

Why Forex Is Popular Among Traders

- World-Wide Access – Currencies are often influenced by international events, resulting in many opportunities available every day.

- High Liquidity – Money is easily made or lost because there is not much delay in transactions, resulting in ease of entering and exiting a position.

- Leverage Options – Even small amounts of capital can be leveraged to trade bigger volumes.

- Variety of Strategies – Forex can be traded in a multitude of ways, from day trading, swing trading and more.

- 24 Hour Market – The forex market does not have fixed hours like stock markets that traders can trade at whatever times which they feel convenient.

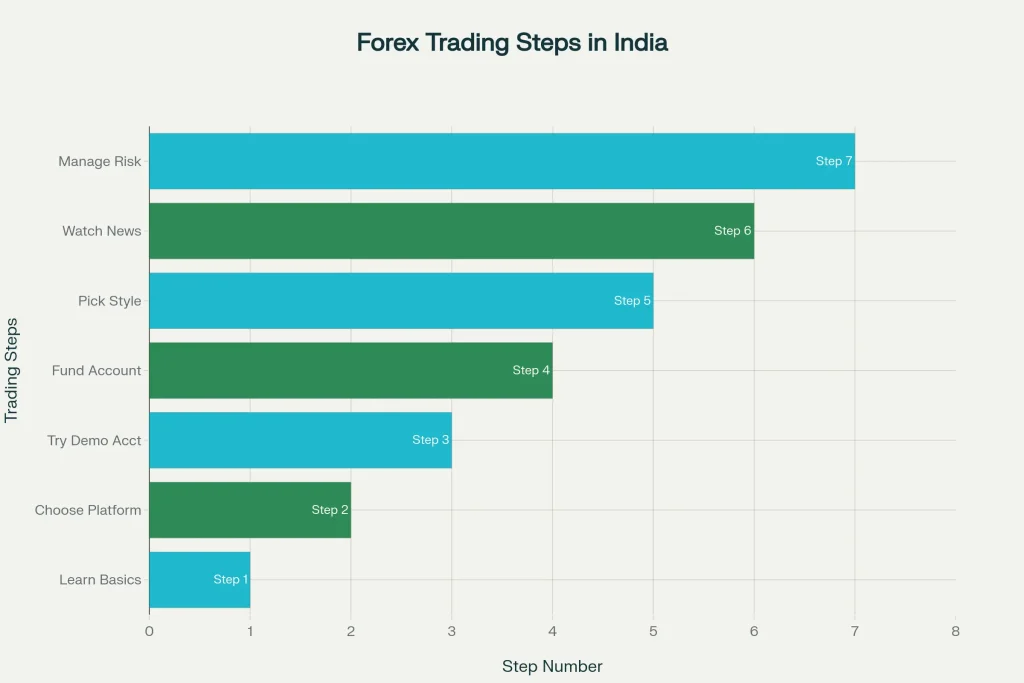

How to Do Forex Trading in India

Step-by-Step Guide for Beginners

Step 1: Get the hang of the basics

First, figure out how currency pairs work. For example, you have EUR/USD or GBP/INR. The first currency in the pair is the base, and the second one is the quote. When you’re trading Forex, you’re basically guessing if the base currency will go up or down against the other currency.

Step 2: Pick Yourself a Platform

Choose a forex platform that has what you need. Look for things like low spreads, quick trades, easy ways to take out your profits, and tools that aren’t too hard to use.

Step 3: Try a Demo Account

The good thing is that most platforms let you try out a demo account using fake money. Playing around here will help you to learn without any real worries.

Step 4: Add Funds to Your Account

Once you feel good about making trades, you can put real money in your account. When you are starting, trade with small amounts to start, while you are testing your trading ideas.

Step 5: Pick Your Trading Style

Think about how you want to trade—quickly, daily, or holding on for longer.

Step 6: Watch the News

The Forex market moves based on global stuff like interest rates, inflation numbers, elections, announcements from the Fed, and what’s happening with the world economy. So, keep up with the news to make smart trades.

Step 7: Handle Your Risk

Before you trade, have a plan. Decide when you’re going to cut your losses Decide when you’re going to cut your losses (that’s a stop-loss) and when you’re going to take your winnings. Stop-loss and take-profit points can stop you from making dumb, emotional choices when the market jumps around. Having these rules in place can make you feel surer about your trades since you know the amount you may lose.

Risks to Keep in Mind

Like all investments, forex also has risks:

- Market Volatility – Sudden news can create quick movements.

- Exposure to Leverage – High leverage can increase both profits and losses.

- Emotional Trading – Fear and greed often reduce good decision-making.

- Inexperience – New traders may overtrade without having an investigative strategy.

By being conscious of these things, you can lessen possible losses and trade with more confidence.

Tools & Strategies for Smarter Trading

- Charts and Indicators – Utilise candlestick charts, RSI, MACD, and moving averages.

- Trading Apps – Mobile applications enable you to keep an eye on trades while on the go.

- Copy Trading – New traders can follow the strategies of experienced traders.

- Diversification – Do not put all of your money into one currency pair.

For anyone considering how to do forex trading in India, my recommendation is to start small, learn, and utilise tools that streamline the decision-making process, along with practice risk management.

Exploring Platforms Like TFX (Unbiased Overview)

When looking down the rabbit hole of forex platforms, you will see options by the boatload. One of these is TFX, which presents itself as a unique solution to traders. Here are the features:

- Zero Brokerage- You keep ALL of your profits.

- High Leverage (up to 1000×) – You can make larger trades with lower capital.

- Instant Withdrawals – You can access your funds anytime you need to.

- Easy to Use – It’s a simple and easy-to-use platform for all traders, beginner and advanced alike.

- 24/7 Support – Dedicated success managers available to assist you quickly.

All of this makes TFX very appealing for traders who are looking for a low-cost, efficient platform. However, like anything (especially a platform), it is always a good idea to use the platform small and test the features to see if the features are useful enough for you to ramp up.

Conclusion

So, you want to try forex trading in India? It’s really about getting a few things down. First, you need to understand how currency pairs work—think of it as betting on which currency will go up or down against another.

Next, picking the right platform is important. You want something easy to work with and that you are comfortable with.

Don’t just jump in with real cash right away! Practice your trading strategies first. Most platforms offer demo accounts where you can trade with fake money. This way, you can test out your strategies.

Trading needs discipline. Stick to your plan, and don’t let your emotions drive your moves. It’s easy to get carried away, but staying calm is key.

Forex trading can be exciting, but it’s not a get-rich-quick thing. You need patience to learn and grow. You really need to know before you trade, and you also need to keep an eye on the risks. Don’t put more money on the line than you can afford to lose.

A lot of platforms give you the stuff you need, like tools and access to trading. They can help learn the ropes. Just keep in mind, these tools can be helpful.

Anyone can start trading with a small amount and learn how things work so they can build confidence.