With the introduction of GST Slab 2.0, India’s long-anticipated Goods and Services Tax (GST) reforms have finally arrived. Slab 2.0 is a new policy that will go into effect on September 22, 2025, and has a much simplified two-rate model that can impact consumption, inflation, and even the flow of capital markets. Most importantly, for investors and traders, specifically for Forex trading in India, this policy is more than just a tax reform; it is an opportunity to adjust their strategies.

What Is GST Slab 2.0?

The GST Council only confirmed a structure of two rates on the basis of 5% and a standard rate of 18%. A very limited 40 % demerit rate for sin goods covers clearly demerit items. The structure is simpler, single 5% and standard 18%merit rate, and no range of slabs to ponder and apply. This simplifies the taxation system, the GST framework, so it is easier for tax authorities and businesses to comply; more efficient for the economy and tax system..

The Key Highlights are:

- Implementation Date: September 22, 2025

- Sector Specific Items: Consumer staples, auto items, fertilisers, chemicals/textiles and certain health items are under the categories impacted by price reductions

- Key Messaging for Government: Without conflict or problem focus for demerit implications, direct messaging to pass savings on to the consumer from the previous tax benefits directly identified demand issues that may emerge.

Auto manufacturers, for example, have already committed to/announced price reductions in line with reductions due to other tax potential item changes, demonstrating that tax efficiencies or savings will mostly flow into the real economy.

Macro Impacts: What This Means for Rupee and FX Flows

Inflation and Monetary Policy

One of the goals of the government is to cool inflation. By slashing GST on critical inputs, consumer price inflation expectations can potentially moderate and take some pressure off the government to tighten its stance. In turn, lower inflation expectations should hold up growth-sensitive inflows to India and help the INR find stability.

Corporate Margins & Imports

Cutting GST on critical inputs such as fertilisers, chemicals, and textiles should also expand corporate margins, allowing companies to re-invest capital into expansion. In the medium term, this could drive demand for imports, thereby potentially impacting India’s current account balance and potentially FX markets.

Market Sentiment & FPI Reallocation

Companies that could see tax relief will likely prompt earnings upgrades, which could mean FPIs rotate allocations. This sort of FPI reallocation usually brings short-term INR volatility, especially at quarter results, naturally with initial expectations, and at the time of official clarifications around implementation.

Forex trading in India: GST 2.0’s Effect on FX Services

The primary adjustment is structural, and not industry-specific. Overall: under GST 2.0, services fall into the standard slab of 18% unless notified otherwise. For traders, this means:

- Brokerage and conversion charges related to currencies will still incur 18% GST on them when this comes into effect on September 22.

- So far, there have been no new carve-outs for forex services.

- Expect clarity from the CBIC circulars as the new implementation moves forward, but budget around the 18% amount.

In Short, Your net cost of trading through banks or brokers should not change, but GST compliance and invoicing should operate smoothly since it follows a two-slab model.

The Opportunities (and Risks)

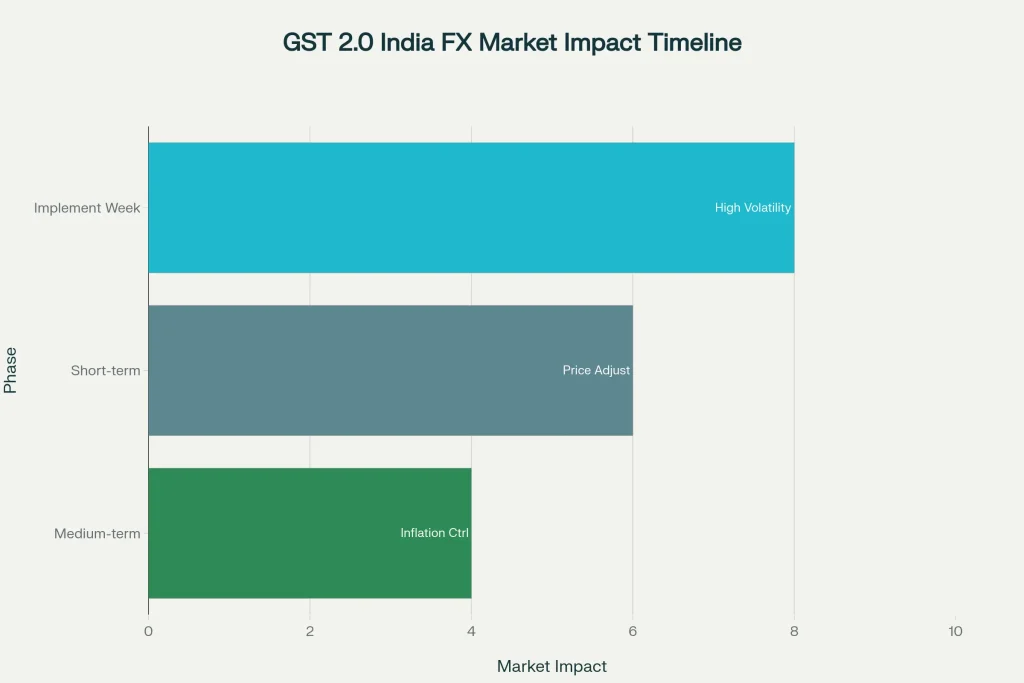

Short-Term (September 2025)

Volatility Window: In the week of September 22, expect INR pairs (USD/INR, EUR/INR) to react to headlines as businesses adjust pricing in response to the change.

Festive Boost: With the Diwali season approaching, there may be reduced prices in autos and consumer goods, which could ramp up demand and be a boon for INR in the very short term.

Medium-Term (Q4 2025)

Inflation vs. Growth: If this reform does its job in lowering embedded costs, then inflation should drop, while growth slows down. That combination keeps carry trades (in INR pairs) alive.

Sectors Revealed through Hedging Flows: Exporters in sectors with reduced tax burden may increase their competitiveness and hedge differently, creating a strong position. Importer-heavy sectors are expanding demand and will hedge with completely different flows.

When, Where, and How to Position

Timing

- Before the Rollout (September 15–21): Trade at a smaller size and hedge event risk. Use options to capture volatility.

- After the Rollout (September 22): After sector pass-through is confirmed based on inbound invoices and price lists, reconsider the held positions.

Focus

- Sector-Specific Flows: Autos, fertilisers, and textiles will really be impactful.

- Currency Pairs: USD/INR and EUR/INR will always respond depending on news and portfolio adjustments.

Trade It

- Scenario Mapping: Track government circulars, corporate announcements and inflation prints.

- Options Strategy: Straddle or strangle trades around the day of the rollout will capture the volatility of uncertainty.

- Hedge Discipline: Place stop-losses around prior-to-reform ranges and avoid holding speculative positions too long.

- Cost Consideration: Do remember that broker service charges continue to attract 18% GST.

Forex Trading in India: A Balanced Approach

The reform is historic; still, traders should construct their strategy with data, not hunches. Expect volatility in late September as sectors adjust to the changes. The optimal strategy is to simply be cautious, rely on volatility strategies, and only modify directional positions once there is clarity after the rollout.

Platforms and Infrastructure: Why It Matters

Event-driven markets test not just a strategy, but also the infrastructure that supports the trader. Having a platform that provides speed of execution, transparency in pricing, and secure, swift withdrawals could be the edge you need. TFX differentiates itself with:

- No brokerage fees, helping you minimise your frictional costs.

- Narrow spreads, enhancing the efficiency of trading in shorter timeframes.

- Reliable and rapid withdrawals, especially during periods of heightened volatility.

Traders should measure TFX against their individual requirements (asset coverage, support, compliance), but the unique selling points make it worth consideration, especially as India shifts into the new tax regime.

Conclusion

GST Slab 2.0 is more than just making taxes simpler. It’s a big change that could really reshape India’s economy. By making the tax system easier, it can change inflation, how the economy grows, and even the value of the Indian Rupee. This can be tricky or a great chance for people who invest and trade.

The change might make markets a bit unstable, mostly with money connected to the Rupee. The people who pay attention, watch what happens in different industries, and understand the news from the government and how companies are pricing things will do the best. Smart trading now means not panicking, but using the ups and downs to your advantage with good plans and careful risk control.

It’s also key to back industries that will likely get a boost, like cars, everyday products, fertilisers, and clothes, because they might get a break from lower taxes. But staying focused is what really matters. Using cheap methods, controlling risks, and using dependable trading platforms means investors can avoid problems and get the most out of things. This is the best way to stay ahead in Forex trading in India while this big tax change happens.