The world of cryptocurrency continually astonishes us. Recently, a little-known trader managed to turn $6,800 into $1.5 million in two weeks by using a method which involved neither memecoin gambling nor following the hype of lucky ETFs. This method was a methodical and infrastructure-heavy style that involved risk management — not something that most traders would discuss with enthusiasm in public.

The story, of course, went bonkers — there’s nothing like a 220× return in a couple of weeks to get everybody’s attention. But integral to the story is a much deeper lesson for traders: it’s not all luck. There was preparation, there was execution, and most importantly, there was an understanding of market mechanics.

In this blog, we will progressively unpack what happened, why it worked, what risks remain, and how traders of any skill level can take away guidance from it without falling into potentially unsafe traps.

What Actually Happened?

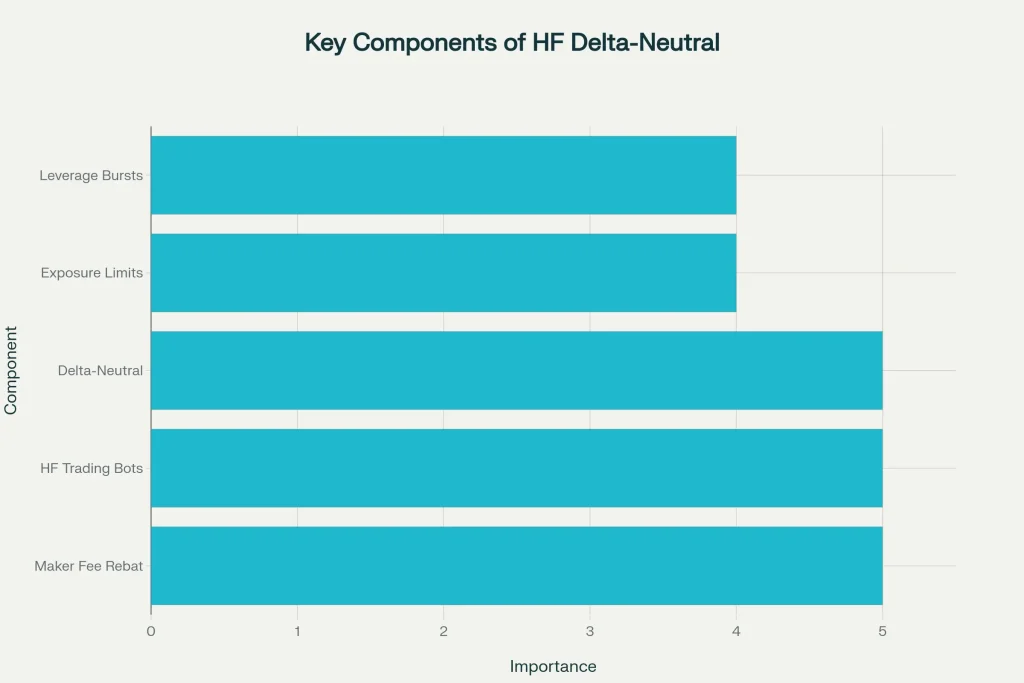

The trader used a delta-neutral strategy on a decentralised perpetual exchange called Hyperliquid. Instead of making crazy directional bets, they focused on hedging their price exposure, gaining profits by leveraging:

- Maker fee rebates (paid to provide liquidity)

- High-frequency trading bots that automatically executed

- Tight exposure limits to avoid big losses

- Controlled bursts of leverage to increase volume

The aim was to create a completely non-directional system, ot having to imagine whether Bitcoin or Ethereum would increase or decrease in price. It operated based on volume, efficiency, and rebates. Within 14 days, it turned $6,800 into $1.5 million.

Why This Is Extraordinary — and Dangerous

While the strategy appears to be clever in theory, it’s not so easy in practice.

- Unachievable to Copy Exactly

Most traders lack the infrastructure, coding abilities, or discipline to do this correctly.

- Not Without Risk

While “delta-neutral” is a good way to limit exposure to price swings, you still have risks such as liquidity gaps, funding charges, slippage, bot errors, and even the exchange grid going down.

- Capital Intensive

To make rebates and spreads a meaningful component of your financials, the vast majority of the time, you need to trade large amounts. If you do not have the right structure in place, the fees and slippage can consume most of their profits.

- You’ve Still Got to have Luck

This trader had favourable market conditions lined up for him. It would not have worked the same in other conditions with the same setup.

Why Now? The 2025 Context

By the end of 2025, perpetual futures will still be one of the most liquid and widely traded sectors of crypto. We’d seen an increase in platforms such as Hyperliquid and decentralised derivatives exchanges; meanwhile, centralised exchanges are facing tougher regulation. It was also clear that:

- Regulatory scrutiny on derivatives continues to increase in the US, EU, and Asia, and

- There is more competition and traders deploying bots and trying to crowd in on similar strategies.

- Also, platform risk (hacking, downtime and smart contract exploits) is still a thing in DeFi.

All of this makes this achievement impressive – but also a cautionary sign that does not necessarily mean it is going to be easily replicated.

Lessons Crypto Traders Can Take Away

While not everyone will climb from $6,800 to $1.5M in the same way, there are ideas to take away:

1. Know what “Neutral” Strategies Mean

Delta-neutral does not mean “risk-free,” but hedging your directional exposure, with all other risks still on the table. Always know what risks you are taking in your position.

2. Infrastructure is Everything

Having good infrastructure is vital. Latency, how you designed your bot, order execution, platform, etc. Even a small misstep can cause you to lose profits.

3. Fees Can Bust You

Be aware of maker vs. taker fees and how they matter. A part of the trader’s edge was primarily from rebates; without rebates, the strategy would bust.

4. Risk Management is Equally Important

Limit your exposure, monitor your drawdowns, and have an exit plan. Even automated strategies can go wrong if you are not on alert.

5. Start Small and Increase

Do not just put in the full amount. Back test, run paper trades, or start with a fraction of your capital to test before increasing.

How You Could Try Something Similar (With Caution)

If you are interested, here is a general roadmap:

- Research Exchanges — Find exchanges with good liquidity and low maker fees with good uptime.

- Test Bots — Start simply while you still have a reasonable feel for slippage/risk.

- Don’t allocate capital you can’t afford to lose.

- Backtest, then paper trade — Don’t skip this step. Many “perfect” ideas don’t survive real-world conditions.

- Scale slowly — If it works & hasn’t blown up in a smaller size, you can consider a colossal market size.

- Be aware of relevant regulations — Check to see what is allowed in your region around leveraged products.

Updated Risks in 2025

To illustrate the story within today’s context:

- Increasing levels of regulatory scrutiny: Some jurisdictions have either capped leverage or banned perpetual contracts altogether.

- Volatility cuts both ways: The upside of higher volatility creates opportunities, but it also creates severe liquidity gaps on the downside.

- Competition erodes edge: As more bots entered the market, spreads tightened significantly, and still harder and harder to farm rebates.

- Technology has faults: Smart contract exploits, oracle issues, or simply a moment of outages can take you from a profit to a loss.

What does this translate to? High-risk strategies have financial risk, but more importantly & operational and systemic risk.

Final Thoughts

Transforming $6,800 into $1.5 million is the type of story that makes traders all over the world aspire to do their best on their trades. However, it is important to understand the nuances here. This is not a moonshot on a meme coin, but rather the result of preparation and discipline, and infrastructure.

However, it is a solid reminder that being a successful trader is not always about predicting the right direction. Sometimes being a successful trader is about taking advantage of an inefficiency, risk management, and sticking to the discipline of the correct platform.

For example, TFX is a trading platform that many traders point out:

- The tight spreads are reducing slippage costs.

- Zero-swap options on certain trades, lowering overnight fees.

- Low or no commissions on some instruments.

- High leverage availability (up to 1000×) — though traders should approach leverage with extreme caution.

- Instant withdrawals improve fund safety and flexibility.

If you are assessing a high-risk trading strategy, then learn the basics, test thoroughly, and then scale when you are ready.

The Bottom Line

The story of the trader starting with $6,800 to eventually manage $1.5M is not a template for wealth creation, and it is a story that will remind you of:

- Preparation is better than prediction.

- Risk management is king.

- Infrastructure and platforms are as important as strategy.

As crypto continues to develop, there will be no shortage of opportunities; the question will be whether you are prepared to seize them properly, with the right tools, knowledge and mindset.