Binance Coin (BNB) has affirmed its status as one of the primary digital assets in the entire crypto ecosystem. BNB’s performance is often driven by a combination of macroeconomic factors, regulatory events, and the growth of the Binance ecosystem itself. Recently, BNB has crossed the significant $1,000 mark, which has led to discourse on what propels this trade and what approaches traders should take towards it.

This blog will cover reasons behind BNB’s rise, risks and scenarios to keep an eye on, and how traders can properly position themselves.

BNB’s Market Position

BNB ranks as one of the most valuable cryptocurrencies by market cap. It boasts a circulating supply of about 139 million tokens and billions in trading volume each day. Because of these characteristics, BNB is one of the most liquid, widely traded altcoins on the market.

BNB’s purposes go beyond purchasing and selling tokens, as it is the fuel for the BNB Chain, a mechanism for subsidised trading fees on Binance, and a utility and governance token on other applications.

BNB’s inherent value has helped the token become more resilient to changing market conditions and ensures it remains a part of the conversation around diversified cryptocurrency portfolios.

The Macro Backdrop: Interest Rates and Market Liquidity

One of the most significant external factors affecting crypto markets is monetary policy. Whenever central banks like the U.S. Federal Reserve lower interest rates or take a dovish approach, money flows into risk assets, including equities, tech stocks, and now more than ever into cryptocurrencies.

BNB is just as impacted by these shifts as are Bitcoin and Ethereum. When rates are lower, it is more palatable for investors to allocate capital to growth-based, higher-risk risks. In these types of market environments, BNB especially gets a bit of momentum as traders want to deploy capital into not just core coins, but high-utility altcoins as well.

The relationship between monetary policy and BNB reflects the importance of an important takeaway – that traders should always keep one eye on macroeconomic news in addition to tracking price momentum using crypto charts.

Ecosystem Growth and Network Upgrades

Another factor in the performance of BNB is its constant advancement in its ecosystem.

- BNB Chain Adoption

BNB Chain is still one of the most active chains in daily active addresses and transactions. DeFi application activity, NFT platforms, and blockchain gaming continue to extend the user base.

- Network Upgrades

Various enhancements, such as the “Maxwell” hard fork, have improved scalability, throughput, and validator efficiency. Developing a faster and more trustworthy infrastructure makes developers see the potential for usage in the future.

- Built-in Utility

BNB is more than just speculation; it has built-in use cases that offer additional value to the token beyond price. Use cases include trading fee discounts, staking rewards, and governance privileges. Such tokens, with meaningful utility, can have consistent demand, unlike tokens that only depend on hype to generate demand.

- Token Burn Program

BNB has a deflationary model since there is a scheduled token burn that occurs. Reduced supply reduces price pressure over time, and because of this, BNB has a much more important long-term value. Especially when you combine increases in demand with decreases in supply, this creates a scarcity factor that builds long-term price support.

Regulatory Developments: A Double-Edged Sword

The regulatory environment is still among the largest variables affecting BNB’s overall sightline. Reports suggested some resolution with many of the challenging legal matters facing Binance and even a potential downgrading in the Department of Justice alertness. Events such as these can bolster confidence and attract institutional players who have been avoidant for fear of exposure.

At the same time, regulatory risk is not fully in the rearview for BNB. New rulings in the U.S., Europe, or Asia could adjust circumstances. For traders, staying on top of legal news will be just as important as staying on top of price charts. A single headline — regardless of polling as positive or negative — can shift sentiment overnight.

Risks and Considerations

Though BNB has had a strong performance, traders should consider the following risks:

- Psychological price barriers: Levels such as $1,000 can trigger momentum for profit-taking and increase short-term volatility.

- Policy reversals: Continued inflation or central banks becoming hawkish could reduce the appetite for risk assets.

- Liquidity shifts: A sudden drop in volume can exacerbate price swings, leaving behind latecomers.

- Regulatory uncertainty: Although there has been progress, crypto remains in a complicated legal environment.

- Macro instability: Geopolitical events or global economic unrest could suppress speculative inflows.

Trading Scenarios

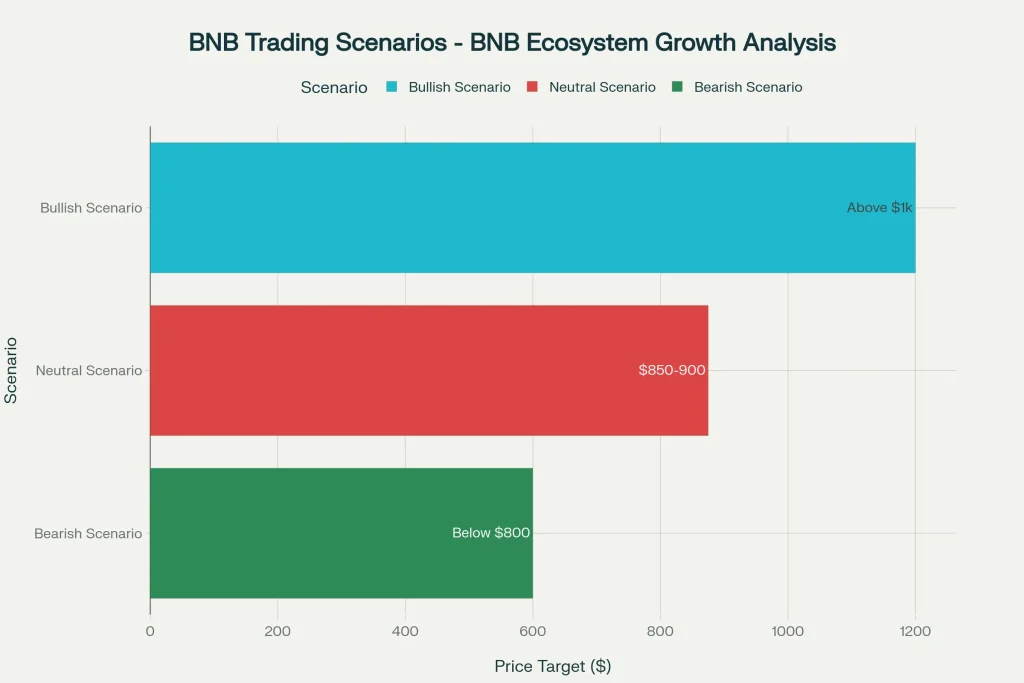

- Bullish Scenario

If BNB remains favourable, thanks to macro conditions, ecosystem improvements, and regulatory clarity, it may even hold above $1,000 and be buoyed further to new highs, leading momentum traders to ride the continued breakout, with trailing stop-losses in place for securing gains.

- Neutral Scenario

BNB may consolidate between support around $850–$900, possibly between resistance at $1,000. In this case, a dollar-cost averaging (DCA) accumulation strategy could work for those medium-term investors.

- Bearish Scenario

If macro conditions or regulations are detrimental, BNB could fall back below $800. If that scenario plays out, it is critical to employ discipline in risk management through stop-loss orders, stablecoin hedging, or simply reduced leverage.

What It Means for Different Types of Traders

- Traders operating on a short time frame should seek confirmation for breakouts above resistance and avoid the tendency to chase trading signals induced by euphoric price spikes. Indicators available in most charting platforms may help with this evaluation. Technical indicators such as RSI, moving averages, and volume are often useful.

- Swing traders may benefit from identifying clear support and resistance zones, entering near or during retracements, and exiting in proximity to the overhead obstacles.

- Long-term investors should spend less time being consumed by short-term price action and instead focus more on the fundamentals, such as ecosystem growth, token destruction, and sustained adoption.

Considering the trader’s style, either short-term or long-term, diversification is key. Even buying BNB, a tier-one token, has risks when one has too much exposure to a single token.

Is BNB a Good Entry Point?

The answer is contingent upon each trader’s risk profile.

- Aggressive strategies might prefer to enter during upward momentum and expect higher highs if fundamentals line up.

- Conservative strategies might wait for an established breakout or wait for a retracement to stronger support.

- Balanced investors would generally establish positions over time and leave capital available to take advantage of market dips.

Patience and discipline are critical. Historically, traders who do not force emotional decisions and put strategies into place generally do better.

Why Platform Choice Matters

One of the most crucial elements of a successful strategy is reliable execution. This is why it is just as important to consider the platform you are trading on as it is to consider the asset. One alternative to consider in trading is TFX.

Some of its benefits include:

- Fast execution and liquidity: Minimise slippage during volatile moves.

- Variety of trading instruments: From spot to derivatives, allowing for short trades and hedging.

- Strong security: Very relevant to protecting your funds amid a complicated environment.

- User-friendly thinking and tools: Well-designed tools to support beginners and advanced traders in managing their portfolio.

In weighing platforms to trade on, all traders should consider their needs to find what platform suits them best. These characteristics are good reasons why TFX is an option for those needing reliability and flexibility.

Conclusion

BNB’s advancement past the $1,000 mark is based on more than just a fleeting hype cycle. It is happening against a backdrop of global macroeconomic restructuring, ongoing development of the relevant ecosystem, and greater regulatory clarity. However, the risks remain – policy reversals could emerge tomorrow, and market sentiment is unpredictable.

For traders and investors, the objective should be to balance awareness of big picture drivers and disciplined risk management. There will always be short-term opportunities for those seeking them, and long-term value is also available for those who focus on fundamentals.

Ultimately, the likelihood of success when trading BNB or any crypto asset is not simply based on someone’s ability to call price direction. The context of trading BNB (and crypto assets) is better – a trader will trade based on reliability and security.

The story of BNB continues to unfold, and with it, opportunities for well-positioned traders.