For a long time, Indian Forex reserves have represented India’s economic strength. As of September 5, 2025, India’s Forex reserves reached $698.27 billion, which is a significant uptick and is a hallmark of the strength of this economy, along with the Reserve Bank of India (RBI) being in a position to strengthen its currency.

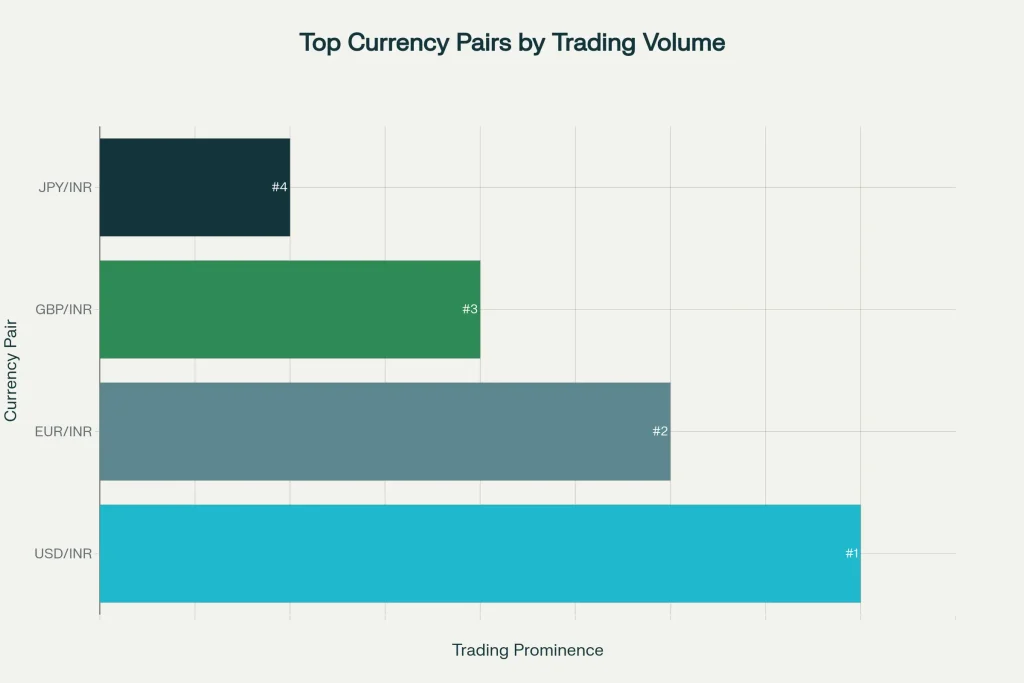

To the world of Forex traders in India, it is important to distinguish which pairs of currencies are traded and how that relates not just to the world economy but as a signal of potential profitable trades. This blog takes you through the most traded currency pairs in India, and some of the forces that impact each currency pair to move.

The Dominance of USD/INR in India’s Forex Market

By far, the USD/INR currency pair trades more than any other in India. This pair shows the Indian Rupee price relative to the US Dollar, which is an important fixture of the Indian economy. The Reserve Bank of India closely monitors USD/INR because its role in the economic and monetary policy in India is a management factor in exports, imports, and monetary policy.

Why USD/INR Leads the Market

There are several reasons USD/INR is the market leader:

- High Liquidity: The USD/INR currency pair sees significant amounts of business from major banks, financial institutions, and retail traders, allowing it to be one of the most liquid markets you could find.

- Economic Indicators: Each country publishes economic data on their own economy. The USD/INR pair is affected by the economic data that each country publishes. GDP growth, inflation, and trade balances are all pieces of data that affect how traders view the value of the USD/INR.

- Central Bank Policies: The policies of the US Federal Reserve and the RBI centrally affect the currency pair’s exchange rate. As each central bank makes decisions to change interest rates, the value of the USD/INR exchange rate responds to those decisions.

- Global Risk Sentiment: The US dollar has historically been seen as a safe-haven currency and is often in demand during down markets or periods of economic rider uncertainty.

With these driving forces in the marketplace, USD/INR will remain a major player in the Indian Forex market and a regular opportunity for active investors.

Other Key Currency Pairs in India

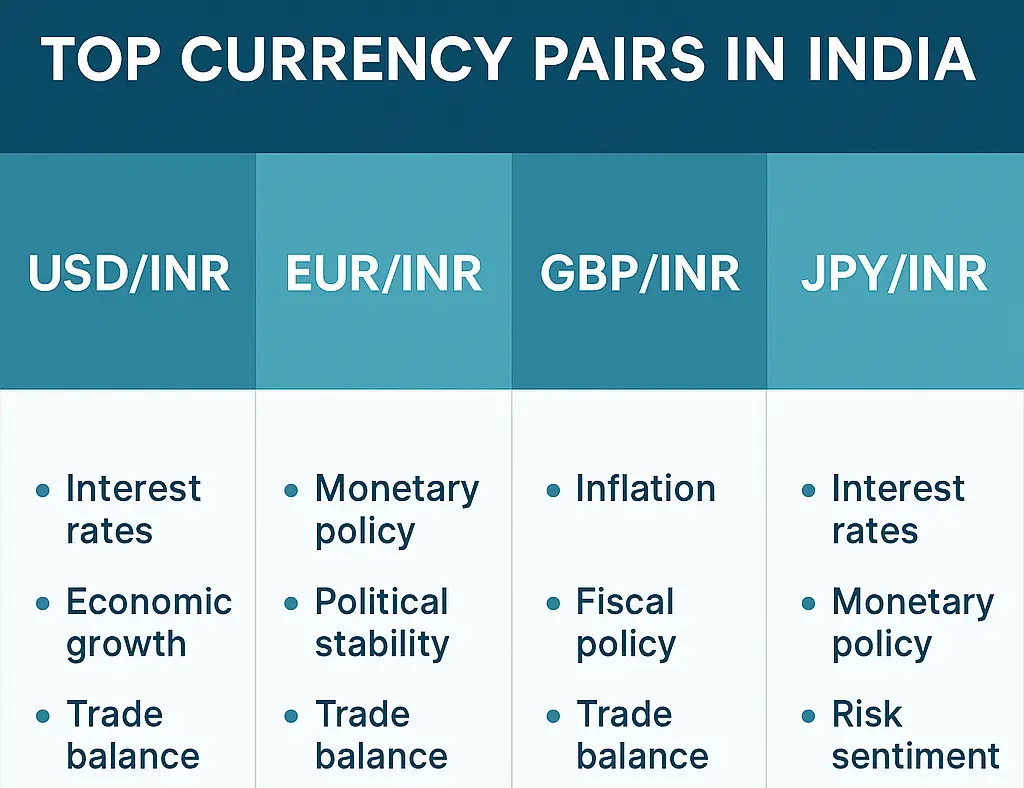

The leading currency pair in India is USD/INR; however, several others are traded actively:

EUR/INR – Euro and Indian Rupee:

The EUR/INR pair means the value of the Euro against the Indian Rupee. Many of the indicators that influence this currency pairing are Euro Zone-based, which include all of the significant economies, including Germany and France, as part of the Euro Zone. Therefore, economic health in the Euro Zone is very significant to this currency pair, including but not limited to GDP growth, inflation, etc.

GBP/INR – British Pound and Indian Rupee:

The GBP/INR pair means the value of the British Pound against the Indian Rupee. The GBP can be highly influenced by economic indicators from the UK, such as interest rates and inflation data. In addition, GBP/INR will certainly be influenced by geopolitical events. The best example is Brexit, which greatly affected the Pound and GBP/INR much volatility over the last couple of years as it progressed.

JPY/INR – Japanese Yen and Indian Rupee:

The JPY/INR is the currency pairing for the Japanese Yen to the Indian Rupee. The Japanese Yen is a safe-haven currency, which means it most often appreciates globally when fear exists, as well as when fears exist related to Japan’s economic indicators as a safe-haven asset or as global sentiment toward risks.

Despite USD/INR being the most popular currency pair, these currency pairs still allow traders to have access to opportunities, particularly those with exposure to global markets.

Indian Forex Reserves: A Pillar of Economic Stability

India’s foreign exchange reserves are vital for maintaining stability in the country’s economy. On September 5, 2025, Indian Forex reserves totalled $698.27 billion, composed of foreign currency assets, gold, Special Drawing Rights (SDRs), and India’s IMF position. The value of India’s foreign exchange reserves is:

- Import Coverage: India’s Forex reserves are equal to over 11 months of merchandise imports, ensuring that the country can honour its external obligations

- Exchange Rate Stabilisation: The RBI uses the Forex collateral to provide stability in the Rupee, especially during times of economic uncertainty or when there is a depreciation in the value of the Rupee.

- Confidence of Investors: Having a well-capitalised Forex position promotes foreign investor confidence, which will eventually lead to higher levels of investment.

Overall, these reserves are important for managing currency stability and avoiding external shocks while also offering traders a greater sense of certainty.

Trading Platforms in India: A Brief Overview

Choosing the right platform is essential for anyone trading currencies. TFX is one of those platforms which provides traders with a clean and easy-to-use interface to help them navigate the difficulty of the Forex market. The platform covers a wide range of currency pairs, including USD/INR, EUR/INR, and GBP/INR, and provides novice as well as experienced traders with everything they need for success.

Why Use TFX to Trade Forex?

- Real-Time Market Data: This platform provides real-time indications to help traders make timely decisions about trades and currency pricing.

- User-Friendly Interface: The platform is user-friendly and provides an easy-to-use platform for traders of all levels.

- Advanced Analytical Tools: TFX provides advanced charting capabilities and extended technical analysis tools to help traders identify trends through careful methodology.

- Low Fees and High Liquidity: Traders will be able to trade at a better rate due to competitive fees and high liquidity. Thus allowing traders to conduct large trade business with minimal costs.

- Education Content: It offers educational content for novices and beginners to help them understand the basic aspects of currency trading and improve their trading ability.

With all of these features, TFX is a great platform for anyone looking to do some trading in the Indian Forex market.

Conclusion

The Indian Forex market is prospering, and USD/INR is the most traded Forex pair. Traders can take advantage of trends, fundamentals, and other factors that influence trading USD/INR, along with other major pairs such as EUR/INR, GBP/INR and JPY/INR. Indian Forex reserves add stability to the Forex market and create a strong foundation for traders.

For those wanting to trade in the Forex market, there are platforms to choose from, such as TFX, that offer a comprehensive set of Forex trading tools for providers to effectively trade and trade with success in an ever-evolving market. The platform provides the necessary tools to help traders understand the complexities of trading Forex, whether you are a new trader to the market or an established Forex market investor.