In the hectic world of forex, loss is inevitable for every trader. Oftentimes, the only distinction between a rookie trader who quits and a professional trader who continues on is vn how they manage loss. Prior to downloading any forex trading apps, it is nice to know the typical blunders that can lead to loss, and more importantly, the unique techniques to avoid these mistakes.

Download Forex Trading Apps That Encourage Discipline

When you are choosing a platform to download, it will not make you profitable. But the right trading platform will give you access to the tools to maintain discipline. Tools like stop-loss orders, margin orders, and real-time trade analytics allow traders to set rules and manage risk without engaging emotions. When evaluating apps, look for transparency, speed of execution, and ease of risk management.

1. Respect Leverage

Forex trading offers great leverage, which in turn significantly increases your potential losses as well. Many traders assume they have a better handle on leverage than they actually do, and end up burning through their accounts with breathtaking speed. Use leverage responsibly:

- Use less leverage than you are allowed (for example, 5× or 10× max leverage instead of full margin).

- Never risk more than 1–2% of your trading capital on a single trade.

- Always apply a strategy in demo mode before trading for real.

- Leverage is a two-edged sword—be careful.

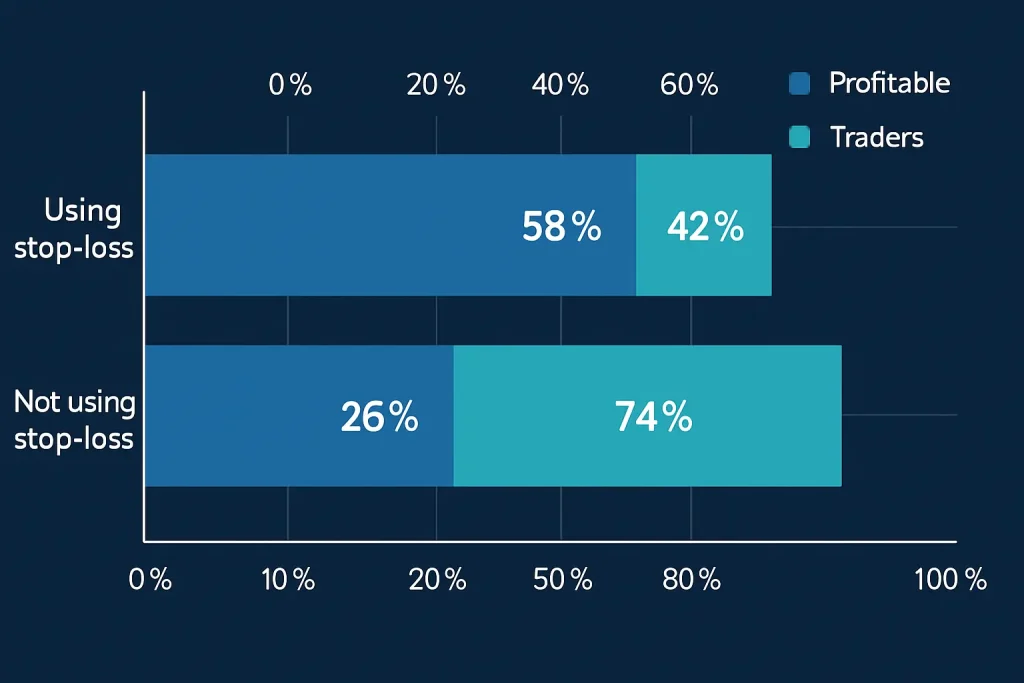

2. Always Use Stop-Loss Orders

Not using a stop-loss is one of the most common reasons that traders lose money. Markets can move very quickly, and without an automatic out, a small loss can snowball very quickly. Good practices for stop-loss orders include:

- Setting stops at logical technical levels, not random numbers.

- Using trailing stops to lock in profits as trades move more favourably.

- Resisting the urge to move or cancel stops after they have been set.

A disciplined stop-loss plan will help to protect your capital when you are emotional.

3. Avoid Overtrading

Many traders end up in overtrading mode—sometimes out of boredom, and sometimes to get back at the market for a loss. Overtrading leads to high transaction costs, emotional burnout, and increased risk.

How to stop overtrading:

- Set a daily or weekly trade limit.

- Seek to take quality setups and not quantity.

- Take breaks after large wins or losses.

4. Diversify from Your Only Currency Pair

If you trade only one or two currency pairs, you run the risk of a surprise. You may get rocked by central bank announcements or political events. The benefits of diversification are safety in numbers:

- It’s okay to trade a variety of pairs, including majors like EUR/USD and GBP/USD, minors and exotics if you want to and can.

- You can also consider other markets like commodities or indices for cross-asset diversification, where possible, through your application.

- Be mindful of your overall positions so that you don’t become overexposed to one currency pair in your portfolio.

5. Use the Economic Calendar to Stay Informed

The FX market is particularly sensitive to news. Unexpected inflation data, interest rate increases or geopolitical tensions can result in prices crashing or exploding in the other direction. Keeping current with the news can help you avoid being blindsided.

- Look at an economic calendar before you trade.

- Try to avoid trading just before an important news announcement, particularly if you’re a new trader.

- You can set alerts or push notifications to monitor news as it happens.

6. Manage Your Emotions

Mindset is as important as strategy. Traders often lose their plans and potential profits because of fear and greed. Successful traders:

- Trade with money they can afford to lose.

- Accept losses as part of the process.

- Remove themselves from the situation after they trade emotionally and return with a clear mind.

Having control over your emotions is one of the things that separates professionals from amateurs.

7. Analyse All Your Trades

Trading journals are one of the most overlooked resources. Write about the details of every trade – entry, exit, reason for, outcome, and feelings. Over time, you will begin to see certain patterns that will help to bring your strategy and trades into focus.

Ask yourself:

- Did I stick to my plan?

- Were my losses within acceptable limits?

- Could I have managed risk better?

Reflecting on your trading in this way will help develop consistency.

During Trading, Tools Matter

Your discipline matters most, but the right structure assists you with discipline. For this reason, it is so worthwhile to download a forex trading app that provides risk controls, transparent costs, and flexibility. Equally important, an app that offers stop-losses, instant funding, and portfolio analytics can support you with your good habits, while you put your energy into the discipline of strategy.

8. Avoid Unrealistic Expectations

Many new traders enter forex hoping to get rich quickly, and this thought process often leads to oversized trades and uncalculated decisions. Successful trading is about taking small, consistent and calculated steps rather than trying to become a millionaire overnight. Set realistic goals, for instance:

- Earning a steady 3-5% monthly return.

- Adding to your capital incrementally rather than chasing one “big trade”.

- Putting survival in the market above making the most out of each and every trade.

9. Take Advantage of Technology for Alerts and Automation

Modern trading applications have made the process of automation possible to help traders ensure they do not make emotional mistakes:

- Set price alerts, which will notify you when the pairs you are tracking reach your target price.

- Only use automation and copy trading after doing due diligence, with traders you trust.

- Use smart order types, for example, OCO (One Cancels the Other), to develop more complex strategies.

Technology will not replace your judgments, but it will help to minimise the costly moments of discipline slips.

10. Practice Patience and Consistency

Forex trading is a marathon, not a sprint. Every week, many traders switch to a new strategy. Find one that you have backtested or that works for someone you trust, and stick with it until you slowly improve it and your wins compound, and you make money consistently. The best traders are those who are players for the long game.

Conclusion: Combining Smart Habits with the Right Platform

The use of leverage, always using stop-losses, diversification, being mindful of all economic events, and controlling emotion are all habits that are important to shape to avoid losses in forex trading. Then, to complement these habits, you use platforms that allow you to engage in risk management and transparency. There are some platforms, such as TFX, designed for traders seeking modern features such as zero brokerage, tight spreads, instant funding and withdrawals, and high leverage options. While these platforms are important, at the end of the day, it is how you use that platform that is most important. Be mindful of this when you download forex trading apps; start with a capital preservation first mentality, and then profits will come.