Introduction

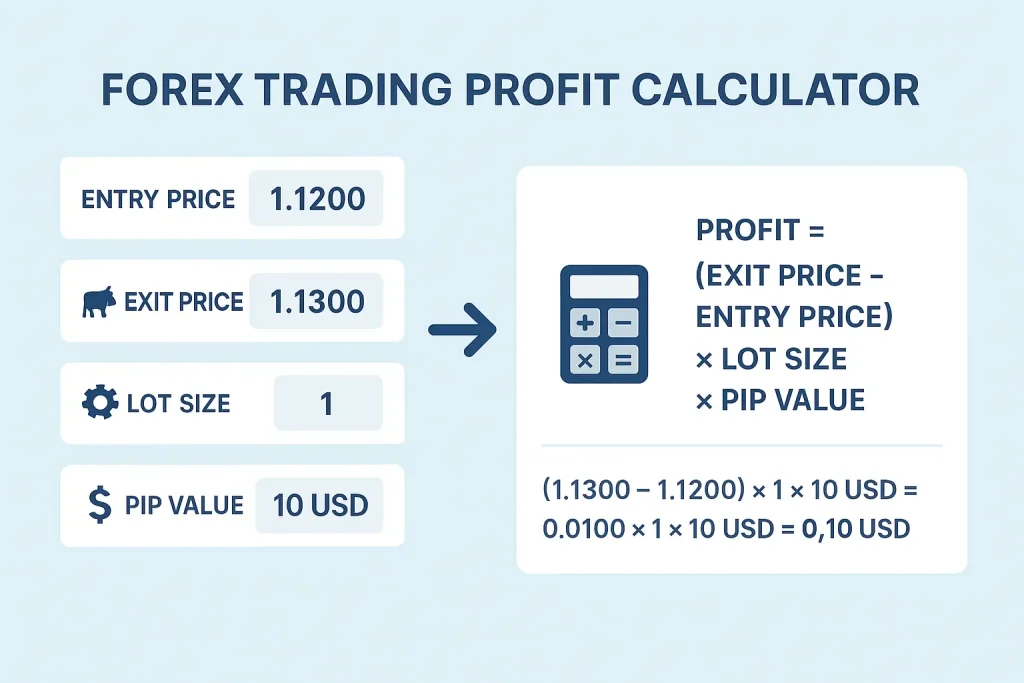

Entering forex isn’t about luck; it’s about strategy, discipline, and using appropriate tools. A forex trading profit calculator can significantly increase your chances of a successful trading experience when used properly. It provides a reliable method for estimating gains or losses based on entry and exit prices, size of trade size, and currency pair. It works as the foundation for successful risk management and planning, which is vital to trading.

Forex trading, unlike stock markets, operates 24 hours a day, five days a week, on a global scale from London to New York to Tokyo. There are trillions of dollars processed by the market on behalf of traders every day, which makes forex the world’s most liquid financial market. While this liquidity creates opportunities, it also magnifies risk. Forex traders need a system to operate, especially in consideration of the high-risk nature of the market.

Forex Trading Profit Calculator — Why Every Trader Should Use One

A Forex trading profit calculator is more than just a number-crunching tool. It offers traders the opportunity to forecast potential results ahead of time, allowing them to approach a trade with better knowledge and confidence. Here are some reasons why a profit calculator is an essential tool for every forex trader:

- Anticipating Results: You can quickly measure your profits or losses before actually entering into a trade.

- Changing Your Plan: You can determine how many lots to trade, or where to place your stop-loss and/or take-profit levels to have an acceptable risk level.

- Making Quick Decisions: Forex is about taking action, and time is money. You’ll save guesstimating and backtracking on your calculations, so you can devote your time to the analysis of the trade and spotting your opportunities.

- Reducing Expensive Mistakes: A quick loss of money in your trading account can come from forgetting an element of your profit or loss calculations. You could also mistakenly overstate your profits or downplay your risks.

For example, if you are trading the EUR/USD and you have a trading account of $10,000. By just inputting your trade size, where you are entering the trade and your stop-loss level into a profit calculator, you’re able to see exactly how that will affect your account in dollars in an instant. Now you’re not guessing, and now you have reasonable expectations.

Step-by-Step Approach to Profitable Forex Trading

1. Recognise Market Sentiment and Factors

Forex is driven by macroeconomic drivers. Currency pairs move according to central bank policies, employment statistics, inflation, and geopolitical happenings.

- Central Banks: The decisions of the U.S. Federal Reserve, in terms of interest rates, usually result in volatility for the USD. The European Central Bank and the Bank of Japan are also influential in their own right.

- Economic Data Releases: Non-farm payrolls (NFP), consumer price index (CPI), and GDP growth measurements can all result in sharp movements regularly.

- Global Events: Elections, wars, and unforeseeable events, like a pandemic, can impact market sentiment.

Example: In September 2025, traders were watching the euro keep approaching 1.1000 due to speculation of tighter policy from the ECB, while the British pound was floating near 1.2300 as UK growth forecasts were looking weaker. Awareness of these factors allows traders to anticipate shifts, rather than run into changes after they have already happened.

2. Select a Strategy—Align It to Market Conditions

Forex is not universal. A good strategy can depend on market conditions:

Trend Trading: Capturing long-term price movements using moving averages or trend lines. For example, when EUR/USD moves higher over many weeks as the U.S. tightening is priced in, trend traders will enter on the dips.

Range Trading: Profitable when the markets are flat. Traders can specify acceptable support and resistance zones. Buying low and selling high.

News Trading: Higher risk, higher reward. For example, the U.S. inflation data released can lead to a spike in volatility for USD/JPY within minutes. News traders must react quickly but will want to maintain discipline.

Scalping: A favoured method of many experienced traders. Scalpers will engage in dozens of trades in a day, looking to profit from the small fluctuations. Liquidity is important for scalping, so typical trade currencies are EURUSD or GBPUSD.

Algorithmic Trading: Almost 90% of forex trades are executed by algorithms. Automated trading systems will execute trades within milliseconds of the market opportunity occurring, limiting emotional impact and optimising the time factor.

Tip: Don’t force one strategy. The flexible trader will weigh the market first, then select the appropriate strategy.

3. Use Smart Tools (Algo, Pip & Profit Calculators)

Tools give traders a way to manage complexity. What are the must-haves?

- Pip Calculators: display how much each pip movement impacts your account. This is important because pip values are different for each currency pair.

- Profit Calculators: let you see how much, if any, you will gain or lose based on the size of your trade and where stop-loss levels are set.

- Trading Calculators: as the name suggests, these provide a combination of multiple tools to give you insight into margins, swap values, pip value, and profit/loss.

- Algorithmic Tools: backtesting platforms and bots are used to eliminate human error and achieve high-frequency trading capabilities.

A Very Practical Example: If you want to buy GBP/USD with 2 lots, you can immediately use a Profit Calculator to assess the potential loss if the price drops 50 pips. Nobody wants to think about a loss, but if you leave exposure unchecked.

4. Risk Management — The Key to Surviving

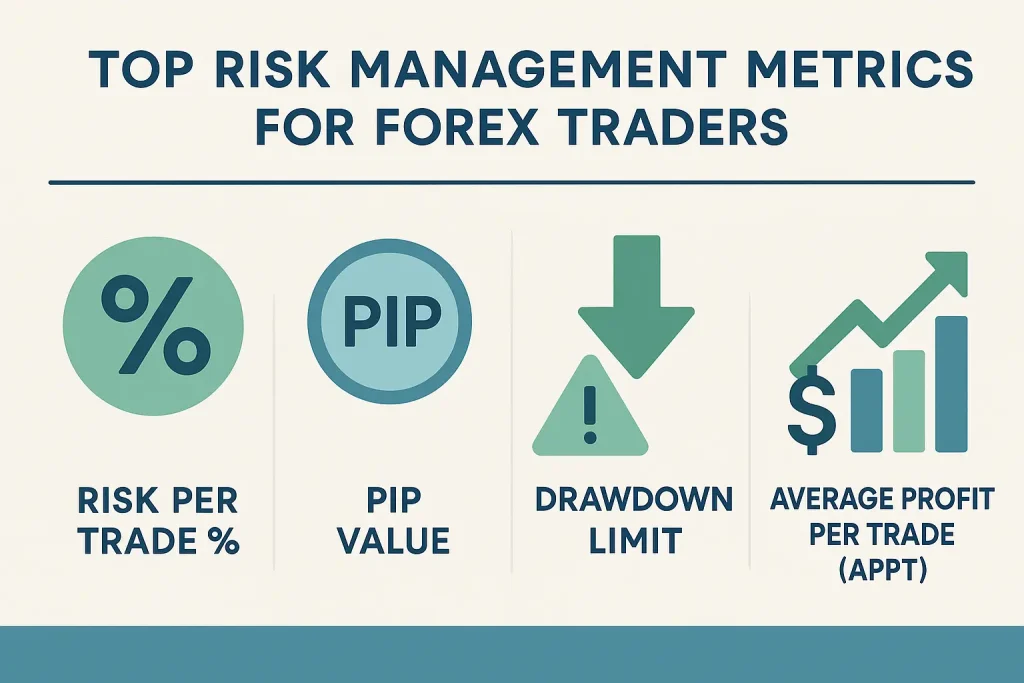

No strategy works without effective risk management. Killing it as a trader means focusing on capital preservation first and profits second.

- Stop-Loss and Take-Profit: Always use stop-loss (SL) and take-profit (TP) orders to provide structure and help reduce the likelihood of emotional trading.

- Position Sizing: Do not risk more than 1-2% of your account’s capital in one trade. In the example of a $10,000 account, this means $100-$200 max risk per trade.

- Avoid Over-Leveraging: While leverage can increase your profits, it can also increase your losses. Conservative traders prefer less leverage for times of safety.

- Drawdown Limits: Prop firms generally will have strict drawdown limits because losses can easily wipe out an account; develop those limits in your own trading.

- Average Profit Per Trade (APPT): Determine expected returns based on the probability of wins against the average win versus the average loss.

Consider risk management like a seatbelt; you may not need it on every trip, but when volatility creeps into your chart, it protects your capital.

5. Plan, Backtest, Execute

Establishing your process. Consistency remains a top priority. Here is a reasonable workflow process for your trading:

- Research: Following economic calendars, the central bank’s announcements, and technical setups.

- Backtest: You want to run your strategies on historical data. If a strategy doesn’t prove to work historically, then it most likely will not work going forward.

- Demo Practice: You want to be able to trade in a risk-free environment while you are learning how to execute the trade.

- Execution: When you go live, you want to make sure that you have an entry plan, stop loss, and exit on your trades.

- Review & Journal: Tracking performance, finding mistakes, and tweaking strategies.

Professional traders will treat their trading like a business. They want to review their results, set targets, and keep iterating.

Bringing It All Together: Sample Trading Flow

Here is an example of how you would structure a forex trade.

- Identify Data: For example, the ECB comments hinting at a rate rise for the euros has a bullish effect.

- Identify Opportunity: The EUR/USD is in an uptrend but retracing towards support.

- Identify Tools: The Forex trading profit calculator tells you what potential profit you would make from buying 1 lot with a 100 pip stop-loss.

- Take Trade: You now put in your buy order where the pullback has retraced to, put in your stop-loss to protect your downside and take profit.

- Stick to the Rules: When volatility hits, do not stray from the trading plan.

- Assess Results: Assess results in your trading log and improve on your next setup after the trade has ended.

By following this process, you will ensure you have reduced the emotional trading and that you have ensured each trading decision is rational.

Subtle Mention of TFX

As you refine your skills, the platform you choose matters. TFX offers a competitive edge with:

- Tight spreads for cost-effective trading

- Transparent pricing with no hidden fees

- A wide range of currency pairs and instruments

- Strong regulatory oversight for added security

- Reliable execution speeds that support strategies like scalping or algorithmic trading.

These features make TFX appealing to traders who prioritise both performance and peace of mind. While no platform guarantees profits, the right tools can enhance your overall trading experience.

Conclusion

Achieving Forex trading success in 2025 relies on combining timely insights, disciplined risk management, and intelligent tools. The Forex trading profit calculator is essential in keeping things in check.

As such, what platform you trade from actually matters. TFX has an added appeal:

- Highly competitive spreads for cost-effective trading

- Honest pricing and no hidden fees

- Very wide variety of currency pairs and instruments

- Carefully regulated for added security

- Dependable execution speeds for scalping or algorithmic trading

In the end, forex isn’t about winning every trade. It’s about managing risk, compounding your gains, and remaining consistent over time. Do your homework, trade smart, be disciplined, and let the numbers lead you.