When individuals analyze the forex trading live chart to identify rupee weakness or global gold prices, one point to take note of: India’s GST reform called GST 2.0 has made significant changes – but it has not changed gold and jewellery taxation. Most goods have seen reclassification, rates rationalised, and slabs simplified, gold still has its own special treatment. This is significant, because gold capture and value is a luxury product and a cultural need product in India, and taxation is a key indicator of consumer and investor behaviour.

Key Features of GST 2.0

The most recent overhaul from 22 September 2025 by the GST Council is regarded as one of the largest shake-up since the introductory roll out of GST in 2017.

- The previous GST system of four main slabs (5%. 12%, 18%, and 28%), has been replaced with a more simplified system which mainly consists of 5% and 18%, and a 40% slab for luxury and sin goods such as tobacco and high-end vehicles.

- A zero-exempt slab still exists for necessities such as food, hospital items, and educational necessities.

- A lot of goods and services have been rationalised into fewer slabs which helps lessen the burden on businesses which reduces confusion and compliance levels.

For consumers, this equals even more transparency and less ambiguity about what rate applies to their daily items. Exporters and manufacturers will see the biggest edges as they will find B2B sourcing easier under this system, however the rates for commodity items (gold, silver, and jewelry) have not changed and this was intentional for the GST Council.

GST 2.0 and the Forex Trading Live Chart

Despite the fact that the GST rate on gold was once again maintained, buyers must remember that taxation is just a small piece of the total price of gold; currency fluctuations, because gold is priced in U.S. dollars, and foreign prices of gold dictate much of the price at which gold is sold. Following how the rupee trades against the U.S. dollar via a live forex trading chart can provide valuable information about gold price movements.

When the rupee’s value drops against the dollar, gold imports are more expensive, and thus domestic prices will increase even if GST remains unchanged. Similarly, if the rupee’s value strengthens, gold prices should ease for domestic buyers.

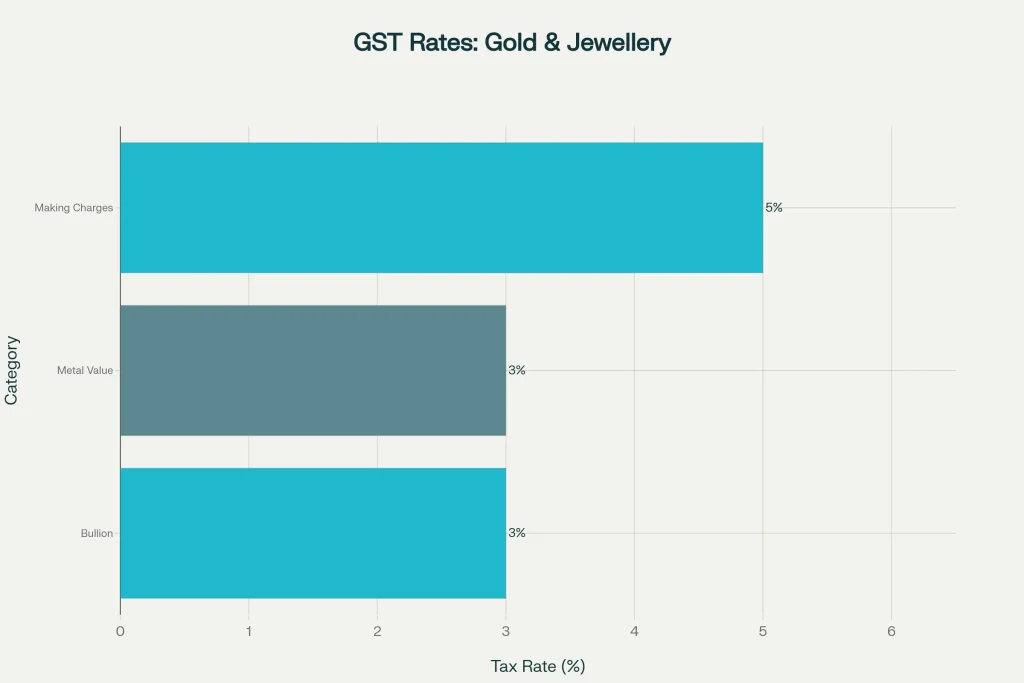

How Gold & Jewellery are Taxed Under GST 2.0

Gold and jewellery lies in a separate category in GST that hasn’t been moved to the higher slabs of 5% or even 18%. Not withstanding the GST on gold and jewellery is straightforward.

Gold and Silver Bullion (Bars, Coins, etc.): Taxed at 3% GST on the value of the metal.

Jewellery: Taxed in two parts:

- 3% GST on the inherent value of the gold or silver.

- 5% GST on the making charges (labour and design).

This double tax ensures that the commodity and the workmanship are both taxed while keeping the overall rate of tax fairly low compared to a luxury item. GM- GST & Gold & Jewellery.

Why Gold Was Kept Out of Major GST Rate Changes

Under GST 2.0, the government had compelling reasons to keep gold prices steady:

- Cultural Significance

Gold is inextricably linked to marriage and other festivals in India, and any major hike in taxation could negatively impact consumption rates or increase purchases from unregulated markets.

- Risk of Illegal Trade

When taxes become too heavy, illegal trade becomes attractive. By maintaining GST at a low 3%, the government has reduced the stigma and incentive to smuggle gold across borders.

- Stability for Industries

The jewellery sector provides jobs for millions of people, employs thousands more as retailers/exporters, and has a significant role in foreign currency and net exports. Predictability in taxation helps jewellers plan purchasing inventory, pricing, and promotions consistent with their business plans without disruption to their operations.

- Consumer Confidence

Only doing so while also avoiding surprises during the largest GST reform should signal to policymakers that they understand ivory tower policymakers need to appreciate the sensitivity around taxation of bullion.

A Look Back: GST on Gold Since 2017

When GST was introduced in July 2017, gold was subject to tax at the 3% rate, which replaced the taxes regime of excise duty and VAT. At that time, there were a few concerns by jewellers as they feared that demand would taper off, however, with a uniform tax at 3%, it created transparency and eliminated a number of state-level taxes.

In its journey over the year, this percentage has remained steady for the most part. Unlike many other commodities that have seen changes to their slab or percentage, gold has enjoyed policy stability, and stability has aided the continued demand for gold.

Real-Time Factors Affecting Gold Prices & Buying Decisions

While GST assures tax consistency, here are the other major factors that affect whether now is a good time to purchase:

Global Gold Prices: Global gold prices are affected by global demand, inflation fears, and decisions made by central banks.

Rupee vs Dollar: Gold sold in India moves with rupee strength or weakness. Watching the forex trading live chart is a simple way to stay on top of currency movements.

Import Duties: A few budgets ago, customs duties were reduced, which made gold a little cheaper. The retail effect will be different.

Seasonal Demand: Weddings and festivals like Diwali create a demand to buy gold, often inflating the price or premiums.

Geopolitical Risks: Wars, conflict or crises tend to make gold a more appealing safe-haven.

Consumer Behaviour: Jewellery vs Investment Demand

Gold has a dual identity in India:

- Jewellery Demand

The cultural and social reason for why jewellery constitutes such a large portion of gold consumption means buyers can be sensitive to making charges and festive promotions.

- Investment Demand

Investment demand is for coins, bars, digital gold and gold ETFs. Investors care more about purity and liquidity than design. They still need to pay GST at the rate of 3%, but they avoid paying anything additional to the making charge.

This dual demand means that if investment flows dry up at any point, jewellery demand behaviour in festivals keeps the market alive.

When Is a Good Time to Buy Gold?

| Situation | Advantage | Considerations |

| Beforefestive/wedding seasons | Avoids sharp rise in premiums and making charges | Risk of global price spike later |

| During rupee strength | Cheaper imports lower domestic prices | Currency can reverse quickly |

| After customs duty cuts | Marginally cheaper prices if passed on by jewellers | Not always reflected immediately |

| During global dips | Spot price softness offers entry points | Hard to predict timing |

For investors, digital gold and ETFs provide convenience, transparency, and lower transaction costs. For jewellery buyers, timing purchases ahead of peak demand is usually better.

Summary: What GST 2.0 Means for Gold Buyers

- GST 2.0 did simplify tax slabs for the majority of goods, but it kept gold’s rate exactly the same at 3% on the value and 5% on the making charges.

- This consistency provides certainty for consumers and businesses in a very uncertain climate.

- The real levers in gold price are and always have been, global markets, rupee exchange rates, and the seasonality of demand, not GST.

Why & When You Should Consider Buying Gold Now

- Protection from Inflation & Weak Rupee: Gold retains value when currency loses its value.

- Diversification: Gold is a hedge that reduces overall risk within your portfolio.

- Festive & Cultural Needs: Purchasing early means you avoid excessive premiums during peak demand.

- Opportunity When Global Drops Occur: Pricing can drop temporarily and create a buying opportunity.

Final Thoughts

GST 2.0 represents a milestone in India’s tax reform, with slabs being simplified for most goods and services. With regard to quite a ubiquitous and easily recognised concept – gold – stability was prioritised in the GST 2.0 process, which sensibly reflected reality. Charging unchanged 3% tax on the metal value and 5% on the making charges presents a recognisable balance, or compromise, between the two systems that need to be considered; that is, on one hand the government needs tax collections, while on the other hand, consumer demand must be met.

For investors and jewellery purchases, prevailing global gold trends, rupee movement, along with seasonal demand, will invariably outweigh GST changes. I think it might be useful to focus on the progressive options for market participants who want to stay ahead, such as platforms that provide real-time price charts, analytical, and true or close to market-execution capabilities. Particularly TFX Ltd., whose platform has the most effective charting system, competitive spreads and reliable access to the market.

And yes – always watching the forex trading live chart is still one of the best predictors of where gold prices might be heading next!