It is important to know the Forex trading time in India, especially for retail traders who want to take advantage of liquidity, volatility, and overlaps in the market. As Forex is the biggest and most liquid market in the world, timing is essential, and it can directly impact profits. In this blog, we will explore the latest trading hours, global sessions, and timing strategy so that you can plan your trades properly.

Best Forex Trading Time in India

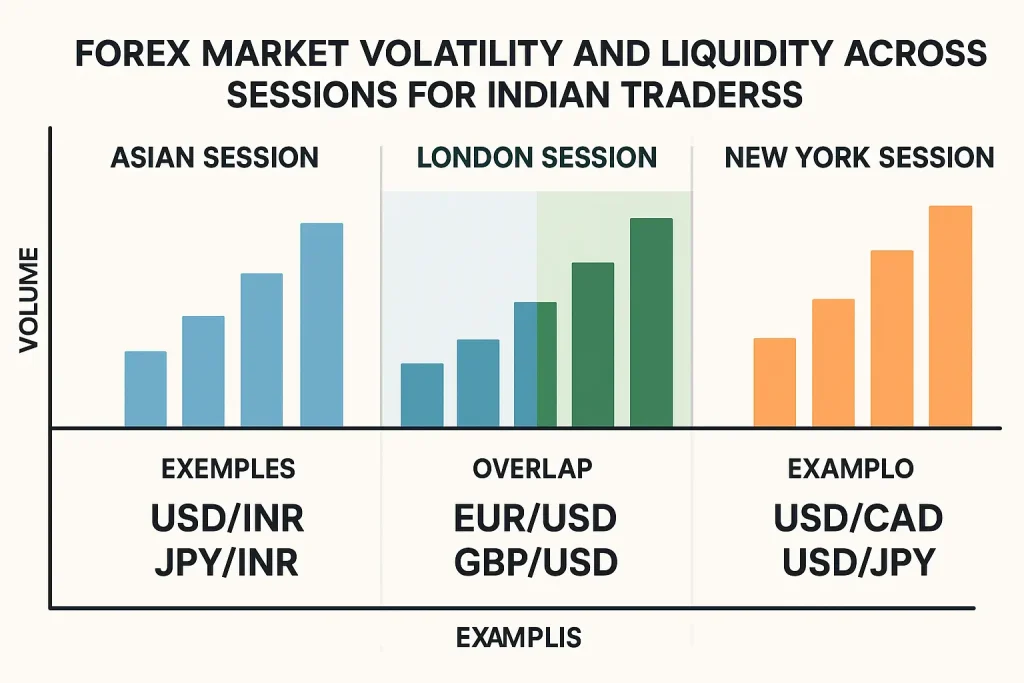

The Forex market is open 24 hours a day, five days a week, at different times around the world, enabling traders to continually trade. The Forex market maintains this schedule because when one major market closes, another one opens. Traders around the world have access to the foreign exchange market, but not all hours will consist of the same liquidity, volatility, and trading opportunities.

For Indian traders, here is how this schedule works for you:

- TRADING INR currency pairs (through NSE/BSE/MCX-SX) hours of trading are from 9:00 AM – 5:00 PM IST. Your INR sessions will cover your primary pairs of currencies based on INR: USD/INR, EUR/INR, GBP/INR, and JPY/INR.

- Cross-currency pairs (such as EUR/USD, GBP/USD, USD/JPY) will trade until 7:30 PM IST. This allows input into the global markets for those traders who wish to stay up late or trade late evening hours.

The London–New York overlap is the hottest marketplace for trading anywhere in the world, and runs from 12:00 PM to 4:00 PM UTC or 5:30 PM to 9:30 PM IST. This time period is considered “prime time” for Forex traders in India because with larger trading volume comes larger price momentum and smaller spreads.

Session Breakdown in IST

| Session | IST Timing | Session Highlights |

| Tokyo / Asian | 5:30 AM – 2:30 PM IST | Best for JPY, AUD, NZD pairs. Liquidity increases around 7:30 AM as Tokyo, Hong Kong, and Singapore open. |

| London | 1:30 PM – 10:30 PM IST | High volatility, especially in EUR/USD and GBP/USD. Considered the most active single session |

| New York | 8:30 PM – 5:30 AM IST | Moves are often driven by U.S. economic data. The overlap with London (8:00 PM – 10L30 PM IST ) produces strong momentum |

Morning (Asian Session)

The Asian session opens at 5:30 AM IST with Tokyo as the lead market. For Indian traders, the morning session (5:30–7:30 AM IST) tends to be slow on liquidity, but typically picks up as more Asian markets open and provide liquidity. By 10:00 AM IST, liquidity begins to decline, so this is an excellent timeframe for range-bound trading strategies, scalping, or technical setups.

Afternoon to Evening (London Session)

The London market opens at 1:30 PM IST, bringing in a flood of liquidity. Typically, when European traders begin to open their trader accounts, many of the pairs, like EUR/USD, GBP/USD, etc., will start to have movements. The first two hours after London opens are considered golden hours for breakout strategies.

Evening Peak (London-New York Overlap)

From 5:30 PM until 9:30 PM IST, London and New York are both open, and the overlap of the two markets is the most volatile and liquid for traders around the globe. If you are trading from India, this is the trading session to focus on because you should observe strong price trends and good liquidity with tighter spreads and plenty of trading opportunities.

Why These Times Matter

Timing is more than convenience – it will affect your bottom line:

Liquidity & Volatility:

The very best opportunities happen when markets overlap and liquidity is maximised. High liquidity also means price pathways are much clearer.

Tighter Spreads:

When the market is active enough, brokers can offer narrower spreads, thus reducing trading costs.

Session Personality:

- Asian Session: Suitable for technical and range-bound pricing strategies, prices move steadily.

- London Session: Volatility, breakouts, and the presence of institutional participants define this session.

- London: New York Overlap Session: The best session for trend-following and momentum trading.

- New York Session (Post Overlap): The session is driven by U.S. data, but the liquidity will decline through the session.

Quick Recap

- Forex trading in India for INR pairs takes place from 9 AM to 5 PM IST.

- Cross-currency trading continues until 7:30 PM IST.

- The best global session for Indian traders is the London–New York overlap (5:30 PM–9:30 PM IST).

- Asian session (5:30 AM–12:30 PM IST) is more suitable for quieter, technical trading.

Market Stability & Technical Conditions

The Forex markets are always accessible globally during these times. There was a brief interruption in liquidity following a technical issue with LSEG’s FX trading system in early 2025, but everything was resolved by March. The whole issue pushed us to think more about having access to stable platforms and diversifying the access methods.

The RBI had just extended trading hours for interbank money markets until 7:00 pm; however, trading hours for retail traders in India have not been extended for Forex trading. Therefore, the structure above is still relevant and appropriate.

To summarise, for Indian traders, pay attention to the London–New York overlap and align your optimisation strategies to the global economic events, which often happen in these two sessions.

Practical Tips for Indian Forex Traders

- Follow the High-Liquidity Hours: Focus on the evening timeframe (5:30 P.M. to 9:30 P.M. IST) for the maximum amount of momentum.

- Use Mornings for Topics & Technical Setups: The Asian session is going to be much calmer and better suited to trading strategies that are support/resistance-based or amending scalps.

- Stay Tuned into Global Events: If there are major economic data releases in the U.S. or Europe, those economic releases will swing the markets pretty significantly.

- Avoid Thin Markets: The later hours at night after 12 A.M. IST) will often see very little activity, so those trades will be harder to execute and likely more expensive.

- Use Regulated Brokers: Make sure your broker is SEBI-compliant for INR pairs, globally recognised for different cross-currency access.

Scenarios: How Indian Traders Can Plan

- Part-Time Traders: If you have a full-time job, the evening overlap (5:30–9:30 PM IST) gives you time to trade after work.

- Morning Traders: Early risers can take advantage of the Asian session (7:30–10:00 AM IST) with consistent and predictable moves.

- News Traders: Pay attention to overlapping sessions when the market releases significant economic data (i.e. U.S. jobs report, or ECB announcements).

By following these time windows based on your strategy, you are not only trading more; you are trading smarter.

Final Thoughts

When attempting to trade Forex in India, timing is everything. Being aligned with the London–New York session overlap, from 5:30 PM–9:30 PM IST, and supporting trades with a consistent, disciplined trade plan in the morning period, can boost trading performance dramatically. The Forex trading time in India is fixed with regulated clarity around the process supported with reliable global access.

If you are looking for platforms to trade within optimum windows as noted, TFX provides an easy opportunity to trade, and offers low-latency execution times, disciplined risk-management tools, multi-currency capabilities, and user friendly interface for new and experienced traders alike. Each trader will judge a broker differently based on each trader’s needs, however, TFX presents serious competition in terms of speed, transparency, and reliability in today’s broker market.