The monetary policy decisions made by the U.S. Federal Reserve affect global markets everywhere, including cryptocurrencies. In September 2025, the Fed cut interest rates by 0.25%, reducing the Fed’s benchmark to 4.0-4.25%; this was the first interest rate cut of the year, and a shift from tackling inflation to supporting growth in a slowing economy.

For crypto traders and investors, this is a major moment. Of course, a natural question is: what does this cut mean for Bitcoin, Ethereum, and altcoins, and what should I do about it?

Why the Fed Cut Matters for Crypto

Historically, when the Fed eases its policy, money becomes cheaper and liquidity expands. This has many ramifications for crypto:

- Cheaper Borrowing Costs: Makes it easier for speculative investments to happen (including crypto).

- Lower Bond Yields: Make safe, low-risk assets less appealing and encourage investors to migrate to riskier, higher-yielding or growth-seeking investment alternatives.

- Dollar Effect: Cuts often weaken the U.S. dollar (money managers need to do something with cash), causing crypto to become even more attractive as an alternative store of value.

- Risk-on Mentality: Lower rates lead to higher investor conviction as they pursue opportunities to take risks in volatile environments.

In summary, crypto does well in environments of decreasing interest rates and in periods of liquidity expansion.

Immediate Market Reaction

The cut in September was not unexpected. The market had been preparing for it for some time, so the actual occurrence brought about nothing noteworthy.

- Bitcoin dipped below $115,000 for a short while before coming back.

- Ethereum remained stagnant around $3,000 without a major breakout.

- Altcoins were mixed: the DeFi and RWA tokens held strong, while meme coins were hit pretty hard.

It’s about what you would expect from the classic “priced in” bubble. The move was expected, so we didn’t have a euphoric spike. In fact, one might say even some traders profited from the “sell the news” dip.

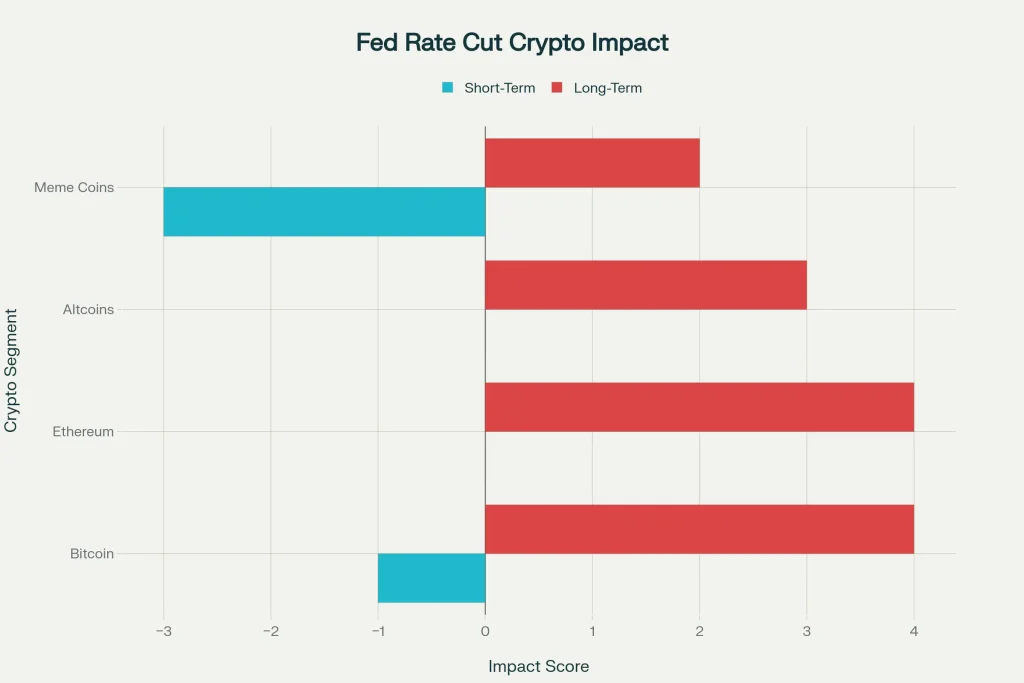

Fed Rate Cut – Crypto Market Impact

| Crypto Segment | Short-Term Effect (Sept 2025) | Medium/Long-Term Outlook |

| Bitcoin (BTC) | Flat to slightly lower; dipped under $115k | Poised to benefit as liquidity builds; may resume uptrend |

| Ethereum (ETH) | Range-bound near $3k | Solid upside as DeFi, staking, and tokenisation grow |

| Altcoins (Majors) | Mixed performance | Could rally with liquidity, but remain volatile |

| Meme Coins | Notable sell-offs | Risky’ may underperform unless sentiment turns frothy |

Why Lower Rates Still Favour Crypto

The price action on the day in question was unimpressive, but the longer-term implications are positive:

- Liquidity flows are extremely important. When borrowing is cheap, institutional and retail investors look for higher returns, and crypto fits the bill.

- Dollar weakness is supportive of Bitcoin. When the dollar is weaker, BTC and ETH duos will appear to be stronger hedges.

- Past performance provides a precedent. In 2020, when the Fed launched a rate cut, crypto entered one of its biggest bull runs in history. The backdrop is different in 2025, but the logic regarding liquidity does apply.

- Analyst Check-In: BlackRock and analysts have mentioned that Bitcoin historically performs better in easing cycles.

To sum it up simply: Short-term noise, long-term tailwind.

Bitcoin vs. Altcoins: Diverging Paths

Cryptocurrency is not a watercolour picture. Each segment behaves differently:

- Bitcoin largely behaves like “digital gold.” It reacts positively to inflows, but at the same time, also attracts capital from investors who are fearful of volatility with smaller tokens.

- Ethereum has added benefits of utility–DeFi, staking–with higher liquidity, and value will be added here.

- Altcoins have upside, but with volatility, and in this market, liquidity may shift thereafter if BTC/ETH has established clear upward momentum or strength.

- Speculative/meme coins are the most damaged and quickly burn ly on hype, but will have large drawdowns during periods of market rationality.

Overall, in a balanced approach: Hold baseline definition in BTC/ETH, and then carefully choose altcoins–and select fundamentals, not just hype.

Historical Context: How Crypto Reacts to Past Fed Easing

Reflecting on history can help investors plan their expectations:

- 2008-2009: Extremely low rates and quantitative easing did not change the crypto market directly (Bitcoin was still new). However, they did provide trust in a monetary system that helped ignite the rise of BTC.

- 2019: The Fed cut rates three times during 2019; Bitcoin also rallied around mid-year. This rally was short-lived when global growth fears took hold.

- 2020 Pandemic Response: Zero rates + trillions in stimulus led to BTC to rise substantially, rising from under $10k to nearly $70,000 in a year.

The takeaway is that Fed easing provides a supportive backdrop, but it is only one factor (sentiment, adoption, discussions in other markets, and external shocks are also important).

Tips for Traders in a Rate-Cut Environment

Practical steps for operating in this environment:

- Don’t Chase Hype: If everyone assumed the cut, prices may not move suddenly in a speculative way.

- Prepare for Volatility: Use stop-losses, and work into better positions over time.

- Think Longer Term: It will take weeks, not hours, to really see the actual impact of easier money being recirculated.

- Diversify: The right balance between BTC/ETH, the core of your holdings, and then a handful of ‘high-growth’ targeted investments in certain altcoins.

- Stay Macro-Aware: These events are not only dictated by the Fed, but certainly consider how inflation data is moving, ETF flows, and global risks, too.

Additional tactical movements:

- DCA: Instead of trying to wait for a “perfect entry”, just slowly build exposure, book-based and suitable with random timing.

- Track Institutional Flows: ETF activity, futures open interest, and Whale wallets typically serve as the earliest indications of this potential.

- Cache Kicking Against Downside: Stay prepared as…always, cash or safe stablecoins, to help buy dips and ease currents.

Looking Ahead

The Federal Reserve mentioned the possibility of additional cuts occurring as early as late 2025. If so, liquidity will only continue to rise, which could assist the next phase of the crypto bull cycle.

Yet, the risks remain:

- A pickup in inflation could cause the Fed to refrain from or reverse its actions.

- Geopolitical shocks can also spur risk-off moves.

- Within crypto, regulatory news, or projects failing could derail individual tokens.

So, while the environment is encouraging, traders will need to stay nimble.

Final Word

Macroeconomics create opportunities and risks in the markets, but your performance is dependent on the execution. A quality trading platform will give you the ability to act quickly and inexpensively.

For example, TFX offers:

- No commissions and tight spreads – that’s efficient!

- Up to 1000× leverage – for traders who want to be levered up!

- Instant withdrawals – to keep your liquidity flexible!

- 1000+ assets to trade in crypto and global markets.

Every trader should use what works for their individual style, but platforms such as TFX demonstrate how a professional-grade set of tools can facilitate a disciplined trading strategy in volatile times.